2018 Tax Bill and Real Estate Investment Planning

Content by Ephraim Schwartz & Teresa O'Dette. Consult your tax advisor to better understand how these changes to the 2018 tax code affect your personal situation.

Every tax return must either: Itemize deductions, or take a standard deduction. It must be one or the other and cannot be a combination. Mortgage interest deduction = Itemizing. Here's what every real estate owner should understand regarding whether to deduct their mortgage interest, OR take the standard deduction:

MORTGAGE INTEREST DEDUCTION

• Mortgage interest deduction is reduced from loan amounts up to $1,000,0000, to $750,000. This is for the primary residence + one vacation home, combined. $1.0M limit is grandfathered for:

- Mortgage debt incurred on, or before, Dec. 15, 2017.

- Mortgage debt incurred on, or before, Apr. 1, 2018, where the purchase contract was signed prior to Dec. 16, 2017 to close prior to Jan. 1, 2018.

- Rate & Term (non-cash out) Refinances of mortgage debt originally incurred prior to Dec. 15, 2017.

• Vacation Home mortgage interest can still be deducted if a primary residence mortgage is less than the $750k limit. If the two (primary & 2nd home) mortgages combined exceed the $750k, then only a portion of the vacation home interest would be deductible. Ex. Primary residence mortgage balance of $500k, and a vacation home mortgage balance of $500k, then all of the primary residence mortgage interest will be deductible, and half of the vacation home mortgage interest will be deductible.

• HELOC (Home Equity Line of Credit) debt interest can only be deducted if it was used for either; purchase, building, or improving the property.

• Cash-out (home equity) mortgage debt is no longer tax deductible. The previous limit was $100k.

STANDARD DEDUCTION

Standard deduction is increasing:

- Individuals: increase from $6,350 → $12k

- Married: increase from $12k → $24k

- Head of Household: is now $18k

The increase to the standard deduction combined with a decrease to mortgage interest deduction means the standard deduction will be the right decision for more people nationwide. This will impact the tax savings for some future purchases, but not all. It's true that first time home buyers of less expensive homes will be more likely to take the standard deduction, than make use of their mortgage interest deduction, going forward. However, in our high cost market, many individuals will still benefit from itemizing their mortgage interest deduction because their mortgage interest is still larger than the standard deduction. So, in addition to other reasons to invest in real estate, owning real estate will continue to be a tax advantage for most in this area.

REAL ESTATE INCOME DEDUCTION – NEW

Income from real estate can be deducted by 20% under the new law.

This deduction will be a new benefit to some vacation & investment property owners in our market. The scenario that will benefit is when the loan amount on a primary residence alone maxes out the allowable mortgage interest deduction, as a 2nd home mortgage interest would not be deductible. Under the new law 20% of rental income is a new deducted on a vacation/investment property.

Example:

Notice both the tax bracket and taxable income change.

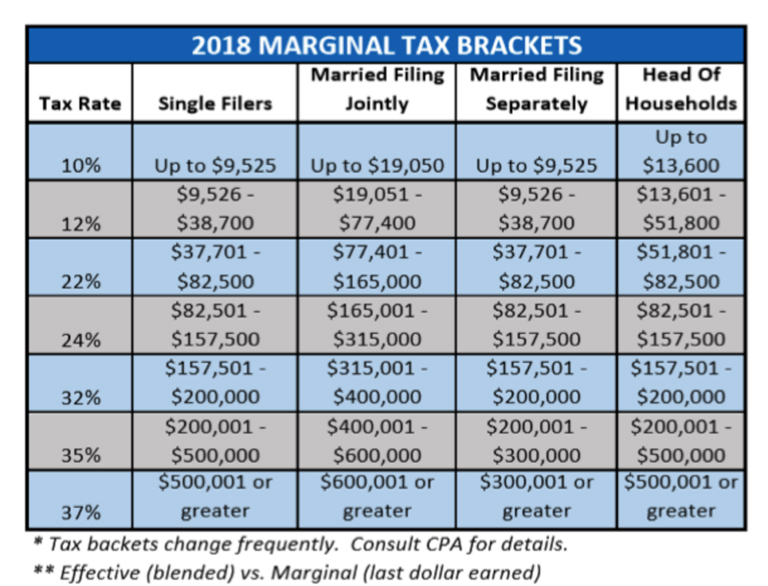

MARGINAL TAX BRACKETS

PROPERTY TAX DEDUCTION

Real estate taxes can now only be deducted up to $10,000. Previously, all property taxes could be deducted at no limit. Property taxes remain fully deductible for businesses or for-profit real estate reported on schedule E of tax returns.

Consider the combination of 20% deduction of rental income + the cap of state & local taxes: Less expensive homes & investment properties with good rental income may benefit, meanwhile more expensive homes not on schedule E are more likely to see an increased cost of homeownership.

GIFT TAXES

Annual:

- 2017 = $14,000/person/year

- 2018 = $15,000/person/year

Lifetime

- 2017 = $5,490,000/person

- 2018 = $11,200,000/person

*Portability between married couples, so actually ~$22.4M lifetime Gift Tax exemption between couples.

The majority of home buyers will not have to worry about their family paying gift taxes for any gifted down payment going forward.

CAPITAL GAINS EXCLUSION FOR PRIMARY RESIDENCE

Remains unchanged. If a property has been the primary residence for any 2 years within the most recent 5 yrs, then capital gains are excluded from tax up to:

- $250,000 for individual

- $500,000 for joint filers

HOME IMPROVEMENTS AS ACQUISITION INDEBTEDNESS

Substantial Improvement

- Adds to the value of the home

- Prolongs the home's useful life, or adapts the home to new uses

24 Month Look Back Period

12 Month Look Forward Period

Content by [email protected], [email protected]

Originally posted by Brit Crezee at Sierra Sotheby's International Realty

Additional resources from Baker, Newman and Noyes, an accounting firm in New England, can be found on their website here.

Boston's Luxury Market Grows to 2nd in the Nation

Second-Tier Surge

New York and L.A. get the attention, but Boston and Denver are rising in the U.S. luxury market

By Andrea López Cruzado

Originally published on September 24, 2015 | Mansion Global

Second-tier metropolitan areas are making their way into the major league of U.S. real estate, showing some of the highest growth rates among luxury markets nationwide.

Denver and Boston rank with San Francisco, Los Angeles and New York in the latest realtor.com luxury home index, which analyzes the top 10 metro areas in the S&P/Case-Shiller Home Price Indices. The realtor.com index measures a market’s high-end growth and entry price, among other factors.

In terms of luxury growth, San Francisco takes the lead, followed by Boston, Los Angeles, Denver and New York. (Metro areas extend well beyond their core city, often encompassing a range of towns and neighborhoods.)

realtor.com

The Denver-Aurora-Lakewood area recorded some of the biggest growth rates. Its luxury market expanded by 18% between 2006 and 2014, reaching a total value of $3.2 billion, according to realtor.com. The Boston-Cambridge-Newton market increased by 12% over the same period, to $4.8 billion.

The realtor.com report uses 2014 as its last full year, and defines luxury as the top 5% of a market. (News Corp, owner of Mansion Global, also owns Move Inc., which operates realtor.com.)

Michael Harper, a real-estate agent with Coldwell Banker Residential Brokerage in Boston, attributed the area’s growth to an influx of wealthy millennials as well as baby boomers who raised children in the suburbs and now want to move to the city. These two set of buyers, Harper said, are competing for the same properties and driving prices up.

Harper recently handled the sale of an apartment at the Mandarin Oriental in the Back Bay neighborhood for $12.5 million, or $3,880 per square foot. The sale was reportedly the most expensive so far this year in Boston.

When the markets are measured by growth in volume of transactions, Denver takes the crown. The Denver area had a 12% increase from 2006 to 2014. Other markets, with the exception of San Diego (at 10%), experienced declines in the number of deals. In Miami, transaction volume was unchanged in 2014 compared with 2006.

Douglas D. Kerbs of LIV Sotheby's International Realty in Denver said the past years' increase in luxury properties has been fueled by a solid local economy and growing demand from people relocating to the city from the East and West coasts, particularly empty nesters and young families.

Kerbs identified Cherry Creek, Cherry Hill, Castle Pines Village and the downtown area as some of the most desirable neighborhoods in Denver.

The realtor.com index used 2006 as its baseline and 2014 as the last full year. While it shows the top 10 S&P/Case-Shiller, scores are calculated relative to the top 50 largest markets.

Write to Andrea López Cruzado at [email protected]